Navigating the AI Landscape: Enhancing Consumer Interactions and Minimising Pitfalls

One of the key areas we have been helping brands on is how to best utilise, deploy and understand consumer AI interaction. Think chatbots, AI checkouts, AI Customer Services, AI message/Ad generation etc.

While many brands seem to be investing quite blindly in this area, others are starting to do their homework before deploying said technology.

If you look there is considerable research literature on the dark side of AI in terms of customer behaviour, attitudes and experience which has been demonstrated to be linked with customer churn, negative reviews and punitive customer responses!

For example, in the hospitality industry, customers exhibited more unethical consumer behaviour when excluded by human staff (vs. service robots) under service exclusion (so not being invited into lounges, fast track queues etc), but more unethical behaviour when served by service robots (vs. human staff) under service inclusion (or taking the experience for granted and not associating it with the brand itself) .

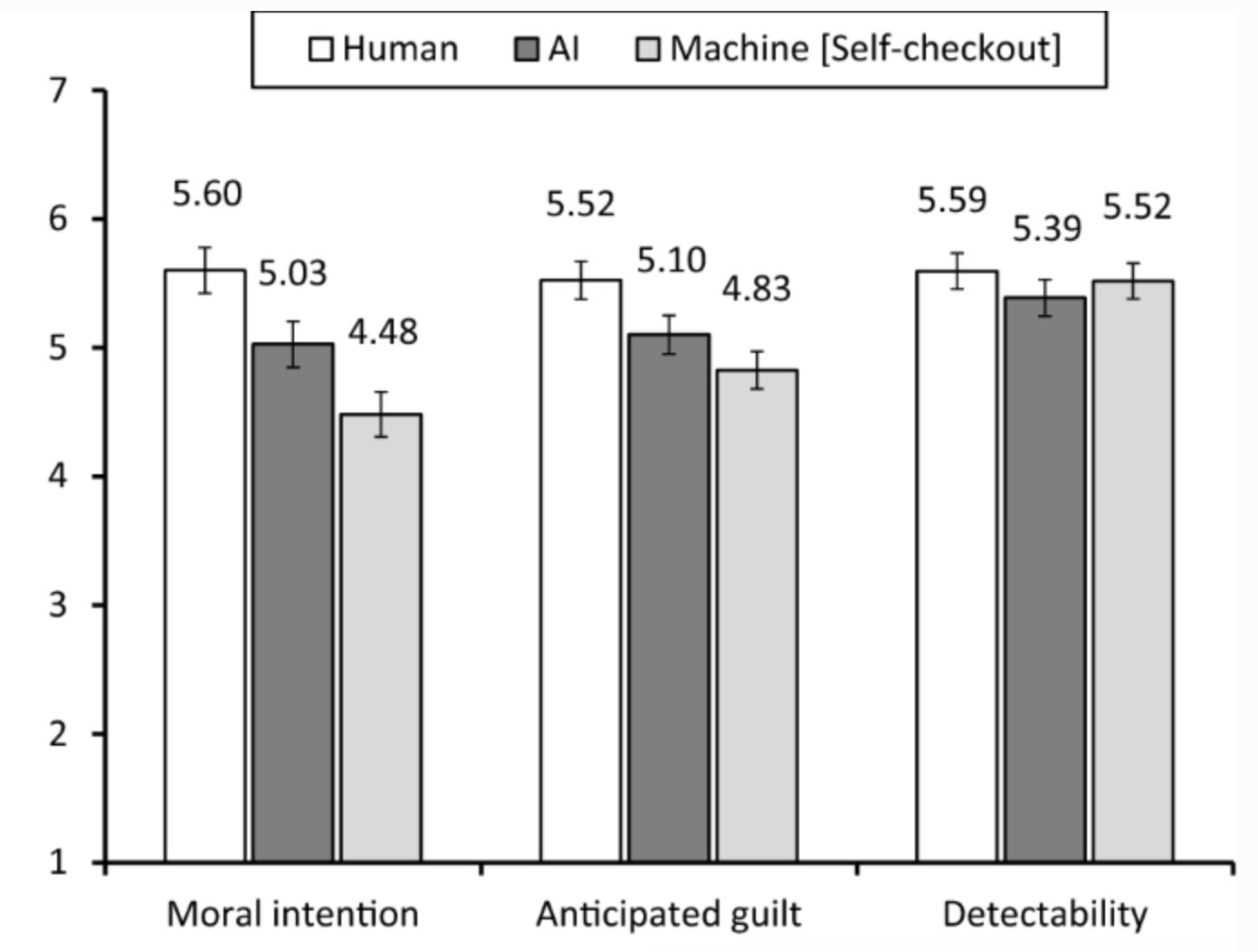

In retail it has been shown that moral intention (intention to report an error) is less likely to emerge for AI checkout and self-checkout machines compared with human checkout (below - Artificial Intelligence and Declined Guilt: Retailing Morality Comparison Between Human and AI).

In relation to charity engagement human–chatbot interactions (HCIs), compared to human–human interactions (HHIs), influence individual morality which has been seen to reduce participants' donation amount.

Even within organisations, employees exhibit more unethical behaviour when interacting with in-house AI systems than the human equivalent.

We have been helping brands and organisation work through this AI landscape, to not only decide what systems are appropriate and when, but also how the basis of these systems should work to maximise positive and minimise negative consumer experiences.

To find out more contact Dr Simon Moore at simon@weareib.co